Common IT challenges in accounting firms include data security and software integration issues. Solving these requires robust cybersecurity measures and seamless software solutions.

Accounting firms face numerous IT challenges in their daily operations. Data security is a top concern due to the sensitive financial information they handle. Cyberattacks and breaches can result in significant financial loss and reputational damage. Additionally, integrating various software systems for accounting, payroll, and tax services can be cumbersome and inefficient.

Firms must adopt comprehensive cybersecurity protocols and choose software solutions that offer seamless integration. Addressing these challenges effectively enhances operational efficiency and client trust. As technology evolves, staying ahead of IT issues becomes crucial for maintaining a competitive edge in the accounting industry.

Credit: www.wolterskluwer.com

Data Security Concerns

Data security is a big concern for accounting firms. Sensitive client information must stay protected. Cyber threats are always evolving. Firms need to stay one step ahead. Let’s look at common security threats and ways to combat them.

Common Security Threats

Accounting firms face various security threats. Here are some common ones:

- Phishing Attacks: Fake emails that trick employees into revealing sensitive information.

- Ransomware: Malicious software that locks data until a ransom is paid.

- Data Breaches: Unauthorized access to client information.

- Insider Threats: Employees misusing or leaking data.

Implementing Robust Security Measures

To protect data, accounting firms must implement strong security measures. Here are some effective strategies:

- Use Strong Passwords: Encourage employees to use complex passwords. Change them regularly.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security. Require a second form of identification.

- Regular Software Updates: Keep all software up-to-date. This includes antivirus programs and operating systems.

- Employee Training: Train staff on recognizing phishing scams and other threats. Regular training helps employees stay vigilant.

- Data Encryption: Encrypt sensitive data both in transit and at rest. This makes it unreadable to unauthorized users.

- Access Control: Limit data access to only those who need it. Monitor access logs for unusual activity.

By following these steps, accounting firms can greatly reduce data security risks. Protecting client information should always be a top priority.

Credit: www.facebook.com

System Integration Issues

Accounting firms often face System Integration Issues. These issues can disrupt workflows and lead to data inaccuracies. Seamlessly integrating various IT systems is crucial for smooth operations.

Challenges With Legacy Systems

Legacy systems are often outdated. They may lack compatibility with modern software. This can create significant integration challenges. These old systems may also be slow and inefficient. They can hinder productivity and increase operational costs.

- Outdated technology

- Lack of compatibility with modern software

- Slow and inefficient performance

- High operational costs

Solutions For Seamless Integration

Several solutions can address these challenges. Migrating to cloud-based systems is a popular choice. These systems offer better compatibility and scalability. They can integrate easily with various modern applications.

Another solution is using middleware. Middleware acts as a bridge between different systems. It helps in data transfer and communication between various software. This ensures that all systems work together seamlessly.

| Solution | Benefits |

|---|---|

| Migrating to Cloud | Better compatibility and scalability |

| Using Middleware | Ensures seamless communication between systems |

Regular system updates are also essential. Keeping systems updated ensures they remain compatible with new software. This reduces integration issues and improves overall efficiency.

- Migrate to cloud-based systems

- Implement middleware solutions

- Keep systems regularly updated

Addressing System Integration Issues is vital for accounting firms. These solutions can help streamline operations and improve efficiency.

Data Management Problems

Accounting firms face numerous IT challenges, with data management problems being at the forefront. Managing and organizing data efficiently is crucial for maintaining accuracy and compliance. Effective data management ensures smooth operations and better decision-making.

Handling Large Volumes Of Data

Accounting firms deal with large volumes of data daily. This data includes financial records, client information, and compliance documents. Managing such vast amounts can be overwhelming.

Here are some common issues:

- Data duplication

- Data inconsistency

- Data loss

These issues can lead to errors and inefficiencies, affecting overall productivity.

Effective Data Management Strategies

Implementing effective data management strategies can help overcome these challenges. Here are some key strategies:

- Data Centralization: Store all data in a centralized location. This reduces duplication and inconsistency.

- Regular Backups: Schedule regular backups to prevent data loss.

- Data Validation: Use validation tools to ensure data accuracy and consistency.

| Strategy | Benefit |

|---|---|

| Data Centralization | Reduces duplication and inconsistency |

| Regular Backups | Prevents data loss |

| Data Validation | Ensures accuracy and consistency |

Using these strategies, accounting firms can manage data more effectively. This leads to better accuracy and efficiency in their operations.

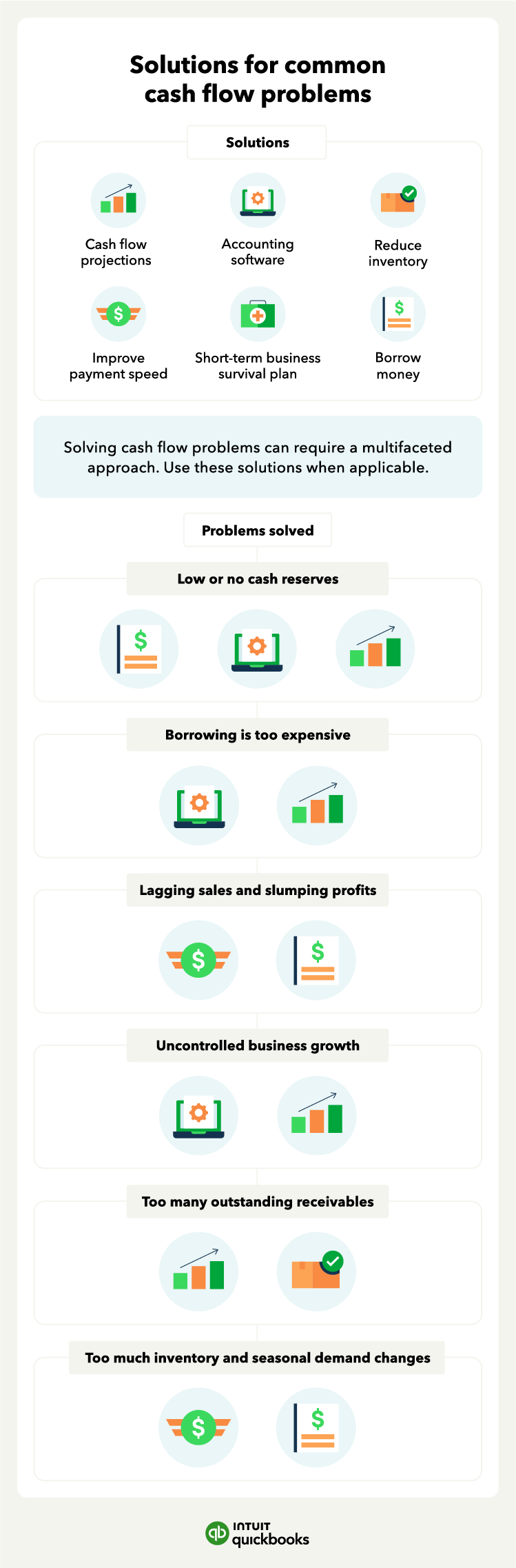

Credit: quickbooks.intuit.com

Software Selection Dilemmas

Accounting firms often face software selection dilemmas. Choosing the right software can be challenging. The right choice can streamline operations and improve efficiency. The wrong choice can lead to wasted resources and frustration.

Choosing The Right Software

Choosing the right software is crucial. There are many options available. Each option has its own strengths and weaknesses. It’s important to evaluate each one carefully.

Factors To Consider

There are several factors to consider when selecting software. Here are some key points:

- Usability: The software should be easy to use. Your team should find it intuitive.

- Compatibility: It should work well with your existing systems. Compatibility avoids integration issues.

- Scalability: The software should grow with your firm. It should handle increasing workloads.

- Cost: Consider the total cost of ownership. This includes purchase price and ongoing expenses.

- Support: Reliable customer support is essential. Check if the vendor offers timely assistance.

Here’s a table summarizing the factors to consider:

| Factor | Importance |

|---|---|

| Usability | High |

| Compatibility | High |

| Scalability | Medium |

| Cost | Medium |

| Support | High |

Evaluate these factors carefully. Make informed decisions. Your firm will benefit in the long run.

Compliance And Regulatory Challenges

Accounting firms face many compliance and regulatory challenges. These challenges can disrupt daily operations. Keeping up with changing regulations is tough. Ensuring compliance can be even harder. Let’s explore these issues in detail.

Keeping Up With Regulations

Regulations change often in the accounting world. New laws, rules, and guidelines emerge regularly. Staying updated is crucial. Failing to do so can lead to penalties. Accounting firms must invest time and resources to keep up.

- Subscribe to regulatory updates

- Attend industry seminars and workshops

- Hire compliance experts

Using software tools can help. Tools that track regulation changes are useful. They alert you to new rules. This ensures your firm stays compliant.

Ensuring Compliance

Ensuring compliance involves many steps. It starts with understanding the regulations. Next, you must implement the necessary changes. This can be complex and time-consuming.

- Conduct regular compliance audits

- Train employees on new regulations

- Document all compliance efforts

Using compliance management systems is helpful. These systems streamline the process. They ensure all steps are followed. This reduces the risk of non-compliance.

| Challenge | Solution |

|---|---|

| Keeping Up with Regulations | Use software tools, attend seminars, hire experts |

| Ensuring Compliance | Conduct audits, train employees, use compliance systems |

Addressing these challenges is key. It ensures smooth operations in accounting firms. Stay updated and compliant to avoid penalties.

It Budget Constraints

IT budget constraints are a common challenge for accounting firms. They often struggle to manage costs while ensuring efficient technology solutions. This section explores how to allocate resources efficiently and adopt cost-effective IT solutions.

Allocating Resources Efficiently

Accounting firms need to allocate their IT resources wisely. This involves prioritizing essential technology and services. Create a list of critical IT needs:

- Data security

- Software updates

- Network maintenance

By focusing on these areas, firms can ensure they are not overspending. Additionally, consider implementing a resource management tool. This helps track and optimize resource usage. Here’s a simple comparison table:

| Resource | High Priority | Low Priority |

|---|---|---|

| Data Security | Yes | No |

| Software Updates | Yes | No |

| Network Maintenance | Yes | No |

Cost-effective It Solutions

Firms can use cost-effective IT solutions to stay within budget. One option is cloud services. Cloud storage reduces the need for physical servers. This cuts down on maintenance and energy costs.

Open-source software is another budget-friendly option. Many open-source tools offer features similar to paid software. This can save firms a significant amount of money.

Finally, consider outsourcing certain IT tasks. Outsourcing can be cheaper than hiring full-time staff. Here’s an unordered list of tasks that can be outsourced:

- IT support

- Network security

- Software development

By adopting these strategies, accounting firms can overcome IT budget constraints effectively.

User Training And Adoption

Accounting firms face many IT challenges. One of the biggest challenges is user training and adoption. Proper training helps employees use new systems well. Encouraging adoption ensures everyone uses the new tools correctly.

Training Employees Effectively

Effective training is key for success. Here are some ways to train employees well:

- Create a Training Plan: Outline what employees need to learn.

- Use Multiple Methods: Combine videos, manuals, and hands-on sessions.

- Provide Ongoing Support: Offer help after the initial training.

A good training plan includes clear goals. It also uses different methods to suit all learning styles. Ongoing support ensures employees can ask questions anytime.

Encouraging Adoption

Encouraging adoption is just as important as training. Here are steps to ensure everyone adopts the new system:

- Involve Employees Early: Include them in the decision-making process.

- Show Benefits: Explain how the new system helps them.

- Recognize Efforts: Reward employees who adopt quickly.

Involving employees early makes them feel valued. Showing benefits helps them understand the new system’s importance. Recognizing their efforts motivates them to use the new tools.

| Step | Description |

|---|---|

| 1. Create a Training Plan | Outline what employees need to learn. |

| 2. Use Multiple Methods | Combine videos, manuals, and hands-on sessions. |

| 3. Provide Ongoing Support | Offer help after the initial training. |

| 4. Involve Employees Early | Include them in the decision-making process. |

| 5. Show Benefits | Explain how the new system helps them. |

| 6. Recognize Efforts | Reward employees who adopt quickly. |

Training and adoption are key to solving IT challenges in accounting firms. Follow these steps to ensure success.

Future Trends In It For Accounting

Accounting firms face many challenges in IT. The future holds exciting trends. These trends promise to solve common issues. Let’s explore the future of IT in accounting.

Emerging Technologies

New technologies are shaping the future. These tools make tasks easier. They save time and reduce errors. Here are some emerging technologies:

- Artificial Intelligence (AI): AI can analyze data quickly. It helps in making smart decisions.

- Blockchain: Blockchain provides secure and transparent records. It reduces fraud.

- Cloud Computing: Cloud services offer flexibility. They allow access to data anytime, anywhere.

- Automation: Automation reduces manual tasks. It increases efficiency and accuracy.

Preparing For The Future

Accounting firms must prepare for these trends. They need to adopt new technologies. Here are steps to get ready:

- Training: Train staff on new tools. Ensure everyone understands the technology.

- Investing: Invest in the latest software. Keep systems updated.

- Security: Strengthen cybersecurity measures. Protect sensitive data.

- Innovation: Encourage innovation. Stay ahead of competitors.

Future trends in IT will transform accounting. Embracing these changes is crucial. It ensures growth and success.

Frequently Asked Questions

What Are Common It Issues In Accounting Firms?

Common IT issues in accounting firms include outdated software, data security concerns, and integration problems. These issues can hinder productivity and compliance.

How Can Outdated Software Affect Accounting Firms?

Outdated software can lead to inefficiencies and security vulnerabilities. It’s crucial to keep software updated to ensure optimal performance and data protection.

Why Is Data Security Important For Accounting Firms?

Data security is crucial to protect sensitive financial information. Breaches can lead to significant financial loss and damage to the firm’s reputation.

How Can Accounting Firms Solve Integration Problems?

Integration problems can be solved by using compatible software solutions and ensuring proper training. This helps in seamless data transfer and efficient workflows.

Conclusion

Addressing IT challenges in accounting firms boosts efficiency and security. Implement robust solutions to stay competitive. Streamline processes and safeguard data. Regular updates and staff training are key. Embrace technology to enhance productivity and client satisfaction. Solving these issues ensures smoother operations and a brighter future for your firm.